Playing to its Strengths: The Key to Growth in India’s Luxury Sector

Which topic dominates your daily newspaper readings? I bet it is India’s evolving luxury sector!

India is being touted as the next China of luxury. A comparison between India and its neighbor is often cited owing to the population size and growth rate in the luxury goods market over the last few years. India witnessed a 33% growth in the luxury goods market in 2022, a phenomenon seen in Mainland China where the market grew by 26% between 2016 and 2019 and by 48% between 2019 and 2020. However, there is a significant divergence in the countries’ economic indicators such as GDP Per Capita: In 2022, India’s GDP per capita was $2.3k and China’s in 2016 and 2020 was between $8k and $10.4k.

Therefore, China’s luxury market size is at a different scale:

China’s contribution to the global luxury market surpassed that of Japan in 2011 and the country has contributed between 25-30% to the global luxury market by consumer nationality in the past decade, with the Rest of Asia (including India) being in the early teens.

In 2010, 85% of the per capita spend on Chinese luxury consumption was driven by core luxury buyers (eg: elite business family members) and luxury role models (eg: celebs), who spent ~$20k or around 10% of their total disposable income. In India, 75% of the transaction spend on personal luxury is below $1.4k and 56% of wealthy business owners spend money on luxury goods.

China’s scale may be different but India’s market presents growth opportunities powered by favorable tailwinds. India’s personal luxury market was at ~$7.2bn in 2024, and is projected to grow by 15% over the next three years. Purchasing power for luxury goods, as measured by the number of affluent consumers1 has been growing for more than a decade, as shown below:

The two prominent classes within India’s affluent consumers include:

India’s elite (UHNWI3 and HNWI3) that is expected to rise by 130%2 between 2023 and 2030. A large majority of this segment has traditionally shopped for luxury abroad due to a wider variety, better experience & customization, and lower prices.

Emerging middle-class aspirants that are increasingly buying premium products that they previously had limited access to owing to geographical boundaries, limited awareness, and low purchasing power. Drawing from India’s neighbor’s example, in China, the middle-class has built solid fundamentals for sustained growth of the personal luxury market in the country. For example, in 2024, the country’s personal luxury market was pegged at ~$50bn, despite an 18-20% decline YoY owing to COVID-related factors, the long-term impact of which is yet to be seen.

The potential is in serving these classes with differentiated offerings, and in nurturing India’s culture and craftsmanship:

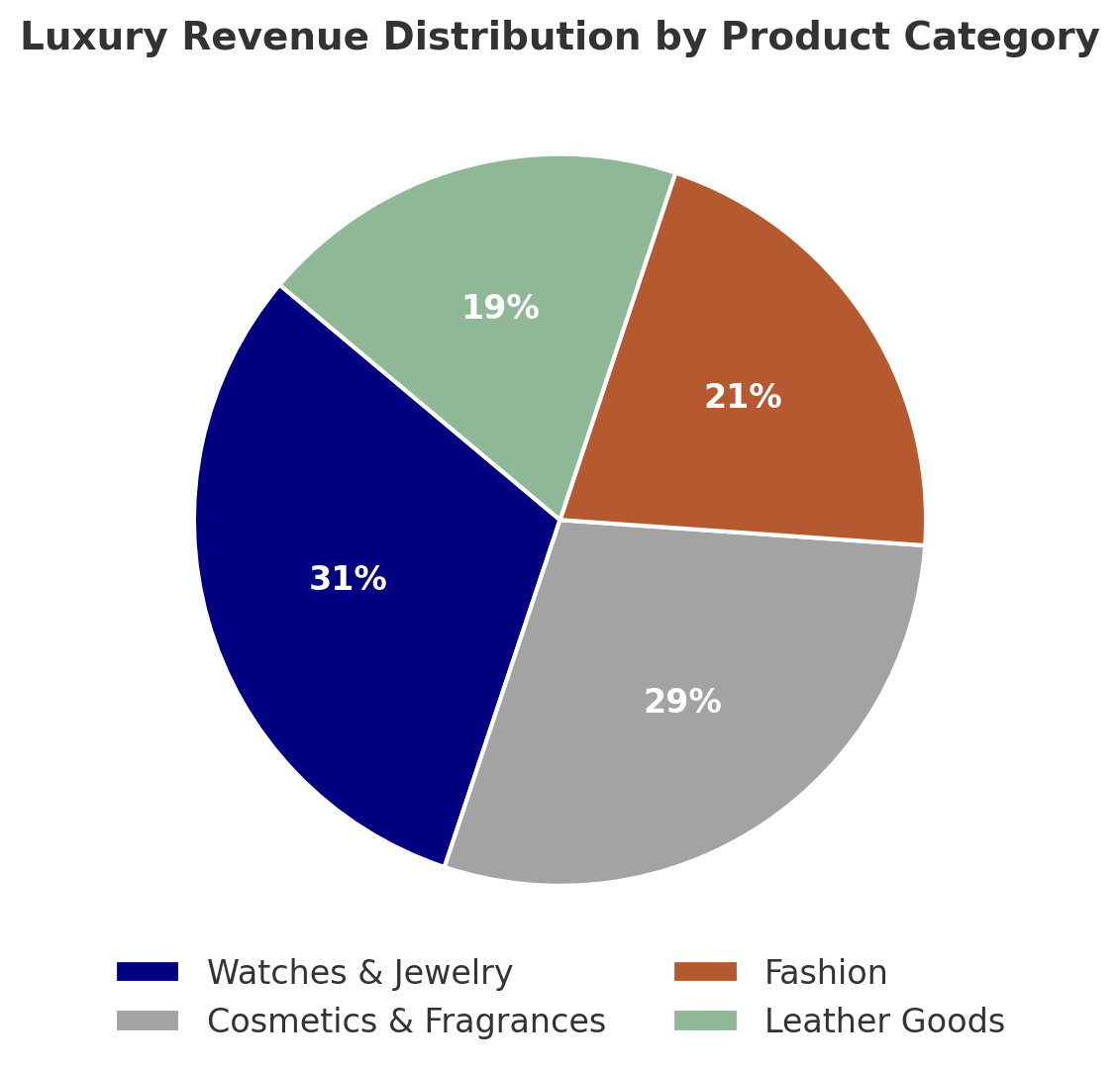

Local brands in personal luxury: The essence of luxury lies in rarity, craftsmanship, and exclusivity. As a result, the luxury market is inherently global, since not all countries possess the resources or expertise to create luxury across all categories. In India, the personal luxury market is primarily driven by watches & jewelry and cosmetics & fragrances, as illustrated below:

In some of these segments, European and American brands dominate, presenting a significant opportunity for Indian-origin luxury brands to establish a stronger foothold. For instance, in the luxury skincare category that is expected to grow at a 24% CAGR between 2023 and 2028, only Forest Essentials and Kama Ayurveda have emerged as major local players. Forest Essentials alone accounts for 10% of India's 2023 color cosmetics and skincare market, second only to MAC Cosmetics, which holds an 18% share. This highlights a clear appetite for high-quality skincare products across both traditional and contemporary formulations.

Similarly, Zoya from the House of Tata, is pioneering the experiential jewelry segment, catering to modern Indian women who seek a blend of storytelling, self-expression, and a fusion of modern and traditional design. Each Zoya necklace is crafted as a statement piece by skilled artisans and designers across India, with the brand's customer experience deeply rooted in Indian hospitality and inclusivity. Established in 2009, Zoya closed 2023 with INR 300 crore ($35 million) from its 12 boutiques and is projected to quickly scale to $100 million in revenue within the next four years, driven by a growing high-net-worth individual (HNI) population in India. Its key competitors include Tiffany & Co. and Cartier, which primarily manufacture and design their collections in the West. However, given that jewelry purchases in India are still largely driven by weddings and festivals (bridal jewelry contributes to ~50% of the total jewelry demand), local brands maintain a distinct advantage. Their deep cultural understanding, access to traditional artisans, and lower production costs give them a competitive edge over Western luxury brands in the Indian market.

Indian brands going global: There is a growing global interest in Eastern philosophies and wellness practices. For instance, one in six adults in the US practices yoga, according to the latest survey data from the Center for Disease Control and Prevention (CDC). The increasing adoption of yoga is evident in cultural moments like International Yoga Day, which is prominently celebrated in locations such as New York City's Times Square. Image below:

Similarly, Indian-origin wellness advocate Deepak Chopra has played a pivotal role in promoting alternative medicine and has gained celebrity status in the U.S. His influence highlights the growing receptiveness to holistic health and wellness, creating an opportunity for Indian-origin brands to expand into global markets.

For brands like Forest Essentials, which blend Ayurveda with luxury, this presents a significant growth avenue in foreign markets. However, scaling globally requires more than just product availability, it necessitates a thoughtful approach that preserves the brand’s core identity while tailoring the experience for international consumers. This could include leveraging online data to refine offerings and ensuring that differentiating factors, such as Ayurveda education, hospitality-driven customer experience, and the sensory elements of the purchase process, remain integral to the brand's positioning. The Company has an active physical presence in the UK and the Middle East. Below is a snapshot from my trip to the Forest Essentials store in New Delhi which educates store visitors about fragrances from multiple parts of India:

A successful precedent is Vahdam Teas (considered premium in India), which has strategically capitalized on India's rich cultural heritage by weaving Ayurvedic storytelling and premium Indian ingredients into its brand narrative. This approach has resonated strongly with US consumers, with the country now accounting for 67% of Vahdam's total revenue and omnichannel presence (present across 6,000 retail stores, including CVS and Wagmans Market), demonstrating the potential for premium Indian brands with global sensibilities to thrive internationally.

Premium brands across consumer categories: Luxury and premium are not the same. Premium brands such as Coach and Massimo Dutti, offer high-quality products at accessible price points, whereas luxury brands, like those under LVMH, emphasize exclusivity, heritage, and craftsmanship. Much like China’s trajectory, India is witnessing the rise of emerging middle-class and Gen Z consumers with increasing purchasing power.

Over the past two decades, India's middle class2 has expanded by approximately 7%, outpacing the total population growth of 2% during the same period. This shift signals a growing market for both premium and luxury brands looking to capture evolving consumer aspirations.

Additionally, Gen Z-driven spending, both direct and influenced, accounts for ~45% of total consumer expenditure across various categories, including consumer tech, video OTT, fashion, and lifestyle. Notably, only 25% of this demographic is currently in the workforce, indicating that much of their purchasing power is driven by aspiration and external influence. As a result, while emerging consumer segments may not yet have the financial means to purchase luxury products, they actively seek premium offerings across all categories, highlighting a clear opportunity.

As a relatively new player in the luxury (and premium) market, India has traditionally drawn inspiration from the West, often seen as the benchmark of success and sophistication. However, by embracing its rich cultural heritage and crafting offerings tailored to diverse consumers, India can shape distinctive luxury brands with the potential to resonate globally.

Notes:

Goldman Sachs: Affluent population in India is calculated as the working-age population that has a per capita income greater than $10,000. % Affluent Labor Force calculated as Population with an income of >$10,000 (in Millions) / Total Labour Force (in Millions).

BCG: The middle class in India is defined as the sum of the Aspirer and Affluent classes. Aspirers: Number of HH with Annual Gross Income of $5.8k-$11.6k. Affluent: Number of HH with Annual Gross Income of $11.6k-$23k.

Bain & Co.: UHNWI have investable assets of at least $30mm; HNWI have investable assets of at least $1mm.